Moody’s/REAL National Commercial Property Index Rose 4.3% In September

(For September 2010)

Moody’s/REAL National Commercial Property Index rose 4.3% in September and it is now running at +0.3% y-o-y.

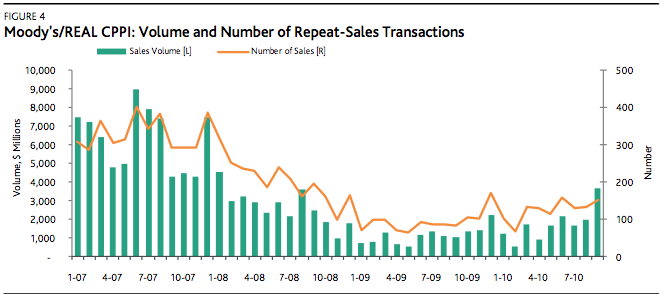

The relatively large swings in the index in recent months are due in part to the uncertain macroeconomic environment and the low number of repeat-sale transactions. In the first nine months of 2010, four months have measured a gain in prices, while five have shown a decline.The total number of repeat-sale transactions increased to 153 in September, a slight uptick over the prior months. Dollar volume jumped to $3.7 billion, up from $1.85 billion in August. This large increase in dollar volume was due to a handful of large loans. There were nine repeat-sale transactions over $100 million in September. This is the largest dollar amount of repeat-sale transactions since January, 2008.

Chart 1. Moody’s/Real National Commercial Property Index

Chart 2. Moody’s/Real National Commercial Property Index – Value And Number Of Repeat-Sales Transactions

Big positive surprise, but I think nobody really knows where are CRE prices heading.